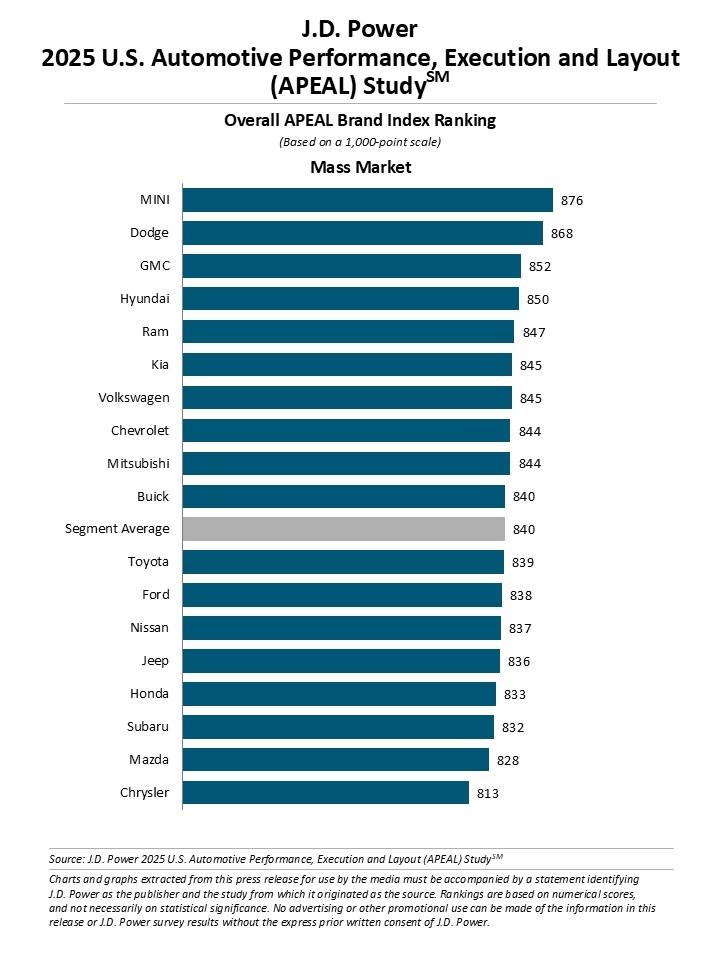

In recent years, Ford has ranked mostly near the mean in J.D. Power’s U.S. Automotive Performance, Execution and Layout (APEAL) Study, which is designed to specifically measure owner satisfaction with new-vehicle design and performance. However, that wasn’t the case last year, when the Ford brand wound up falling below the mass market segment average of 838 points with a score of 831, placing it ahead of only Toyota, Jeep, Subaru, and Mitsubishi. In the 2025 APEAL Study, Ford did manage to rebound slightly, however.

In the 2025 APEAL Study, Ford wound up with a score of 838 out of 1,000 possible points, which is a seven-point improvement versus 2024, but also still slightly below the mass market average of 840. Mini ranked atop all mass market brands with a score of 876, with Dodge, GMC, Hyundai, Ram, Kia, Volkswagen, Chevrolet, Mitsubishi, and Buick all managing to post scores that were above the mean. As for Ford, it beat out Nissan, Jeep, Honda, Subaru, Mazda, and Chrysler this time around.

J.D. Power’s APEAL Study asks vehicle owners to consider 37 different attributes, including the sense of comfort they feel when hopping in those vehicles and the excitement they garner from the driving experience itself. Those responses are then aggregated to compute an overall APEAL Index score, and this time around, is based on responses from 92,964 owners of new 2025 model-year vehicles who were surveyed after 90 days of ownership. Interestingly, the 2025 APEAL Study’s overall satisfaction of 851 is the highest since the study was last redesigned in 2020, signaling that owners are more excited about their new rides than ever.

“Manufacturers have made significant advancements that continue to redefine the vehicle ownership experience and have become more adept at translating innovation into meaningful customer engagement,” said Frank Hanley, senior director of auto benchmarking at J.D. Power. “However, the study finds that owners of new models have lower levels of satisfaction with vehicle setup and startup – as well as infotainment systems – compared with owners of carryover models. This suggests that increasing technology and menu complexity remain persistent challenges for the industry.”

No Comments yet