As is the case with much of the automotive industry over the past few years (following the onset of the pandemic in early 2020), Ford inventory levels have been on a bit of a roller coaster ride. After a long period of time when it was difficult to find new vehicles on dealer lots, in general, that changed in a dramatic way as automakers flooded those same lots with new vehicles. As such, Ford inventory levels remained among the highest in the industry for a while before beginning to fall over the past few months, but that changed once again in the month of June.

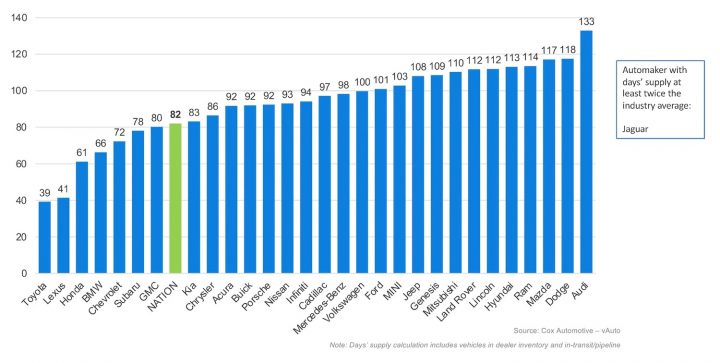

According to new data from Cox Automotive, new Ford inventory levels ended June at a 101 days' supply of inventory, which is quite a lot higher than the past few months. The Ford brand posted an 85 days’ supply in April 2025, in fact, a figure that remain unchanged in May. Now, after making quite a bit of progress, Ford inventory levels are once again back above the 100 days' mark, where they remained for quite some time prior to April - which is a lot higher than the national average of 82 days', as well as several of its rivals.

Cox Automotive notes that inventory across the entire automotive landscape is building, largely due to the arrival of 2026 model year vehicles, but is still 1.4 percent lower than a year ago. At the beginning of July, there were 2.83 million new vehicles sitting on dealer lots, which is 14.5 percent more than the 2.47 million units at the beginning of June. That increase applied to most brands on this list, and due to slowing overall sales, the average days' supply of new vehicle inventory grew by a whopping 12 days over that same timeframe.

"As inventory levels rise and new model year vehicles begin to populate dealer lots, the automotive market finds itself in a delicate balance," Cox Automotive noted. "Supply growth has not been matched by demand, pushing days’ supply higher, and average listing prices have largely plateaued. With incentives holding relatively firm as well, shoppers can expect a market marked by incremental change rather than dramatic shifts. Tariff negotiations have been kicked down the road for another three weeks, which means it could be the fourth quarter before we see any significant movement in overall consumer prices. For now, patience remains a virtue, and attentive consumers may find value by tracking nuanced movements in pricing and inventory as the year progresses."

No Comments yet