Ford inventory levels have been on a bit of a roller coaster ride over the past few years, hovering near or at record lows during the pandemic before exploding to new record highs as supply chains normalized and production got back on track. In fact, Ford inventory levels remained near the top among its peers for some time, above the 100 days threshold, before dropping to an 85 days’ supply in April 2025 – a figure that remain unchanged in May before growing back to 101 days in June. However, things did improve a bit in July.

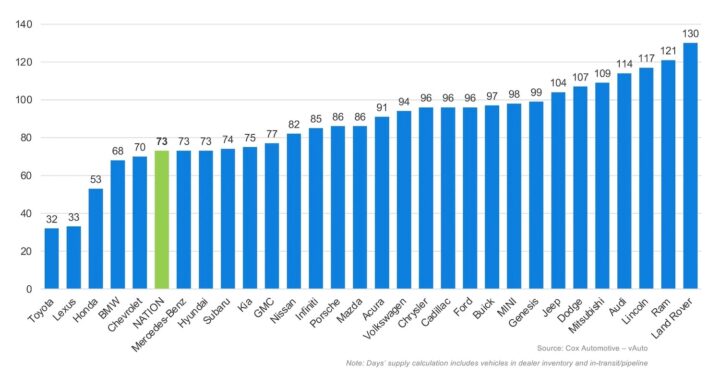

According to new data from Cox Automotive, Ford inventory levels closed out last month at a 96 days’ supply, which is indeed an improvement, but also, well above the overall average of 73 days. It also ranks Ford behind Land Rover, Ram, Lincoln, Audi, Mitsubishi, Dodge, Jeep, Genesis, Mini, and Buick, as well as ahead of the rest of the pack. Toyota and Lexus continue to manage inventory levels better than all of them, with both coming in at the low-30 days’ supply mark yet again.

As for the overall automotive market, it averaged a 73 days’ supply in July, declining by seven days and around one percent month-over-month, to 2.68 million vehicles. That was aided in part by robust sales that grew 8.7 percent versus June, removing 25,840 vehicles from dealer lots. Inventory levels have dropped 4.7 percent year-over-year, while sales were 10.1 percent higher than July 2024. even as pricing remains steady.

The average new vehicle list price decreased by 0.3 percent month-over-month, to $48,480, which is the lowest since April, though also 2.8 percent higher than a year ago. Average transaction pricing decreased by $59 to $48,841, while incentives increased by 0.3 percent to 7.3 percent of ATP – the highest of any month in 2025 thus far.

“As we wrap up July’s market review, it’s clear that the U.S. auto industry continues to navigate shifting tides with resilience,” Cox Automotive stated. “Inventory is tightening just as sales momentum grows, and while tariffs remain a thorn in automakers’ sides, smart incentives and fresh models are keeping buyers engaged. Price trends have stabilized despite underlying volatility, proof that both dealers and consumers are adapting quickly. As we look ahead to upcoming Model Year 2026 launches and the evolving EV landscape, expect the market to stay dynamic and competitive, with savvy shoppers ready to seize the next opportunity.”

No Comments yet