Lincoln Automotive Financial Services – the luxury brand’s financing arm – didn’t fare so well in the 2024 version of J.D. Power’s U.S. Dealer Financing Satisfaction Study, which focuses on automotive lenders, both in the mass market and premium segments. Lincoln scored 784 out of a possible 1,000 points, which ranked it beneath the segment average of 799, as well as near the bottom of the pack, in fact. Unfortunately for Lincoln, its dealers seemingly weren’t totally satisfied with its financing division across the past year, either.

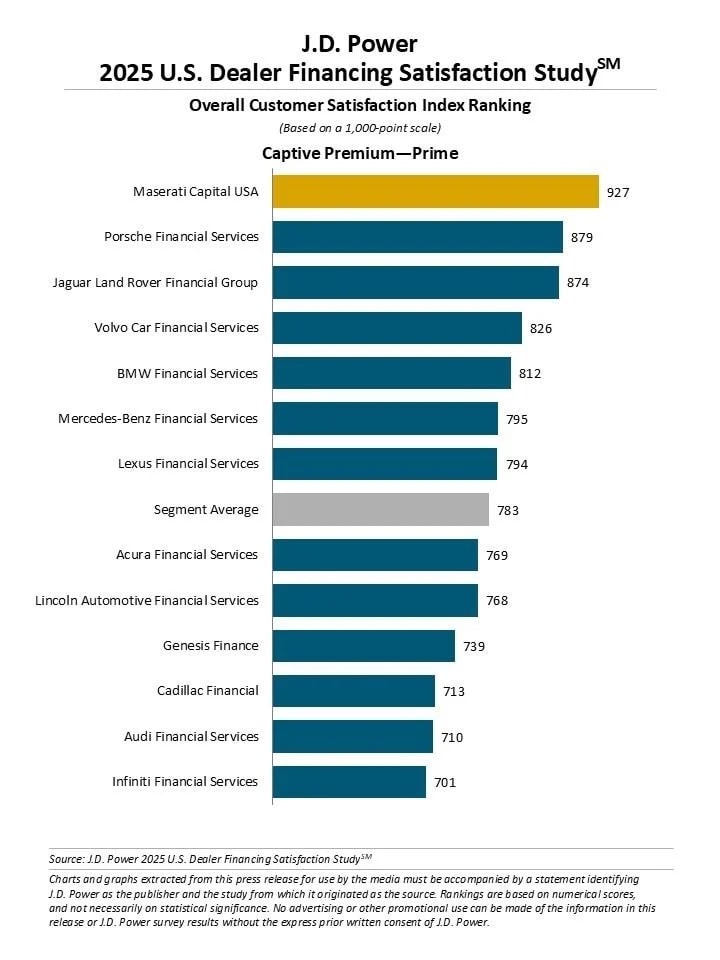

According to the 2025 J.D. Power U.S. Dealer Financing Satisfaction Study, Lincoln Automotive Financial Services once again ranked near the bottom of the premium pack with a score of 768 out of 1,000 possible points, which places it below the segment average of 783, as well as behind all of its peers, save for Genesis Financial, Cadillac Financial, Audi Financial Services, and Infiniti Financial Services. Interestingly, Ford Credit fared much better, ranking fourth among all mass market captive lenders.

The J.D. Power U.S. Dealer Financing Satisfaction Study measures auto dealer satisfaction in five segments of lenders – captive premium/prime; captive mass market/prime; non-captive national/prime; non-captive regional/prime, and non-captive sub-prime. This year’s version of the U.S. Dealer Financing Satisfaction Study is based on 24,085 total evaluations from 5,035 auto dealer financial professionals, and was conducted between April and May 2025.

This time around, it found that national banks have significantly outperformed regional banks in overall satisfaction and dealer intent for a third consecutive year. Regional banks have narrowed the gap, but they still trail national banks in all five of the aforementioned metrics.

“National banks continue to demonstrate the resilience and adaptability that set them apart in today’s economic climate,” said Patrick Roosenberg, senior director of automotive finance intelligence at J.D. Power. “If regional banks want to stay competitive, they must clearly differentiate their value proposition and show dealers how their services are superior in meeting their needs. Without that, they risk losing relevance – and market share.”

No Comments yet