In the recent past, Ford dealers haven’t ranked terribly well in J.D. Power’s Canada Customer Service Index – Long-Term (CSI-LT) Study, which measures service usage and satisfaction among the owners of vehicles that are 4-12 years old, and analyzes the customer experience in both warranty and non-warranty service visits. In fact, over the past two years, Ford dealers have ranked below the industry average in that regard, but in the just-released 2025 CSI-LT Study, those same dealers managed to bounce back in a big way.

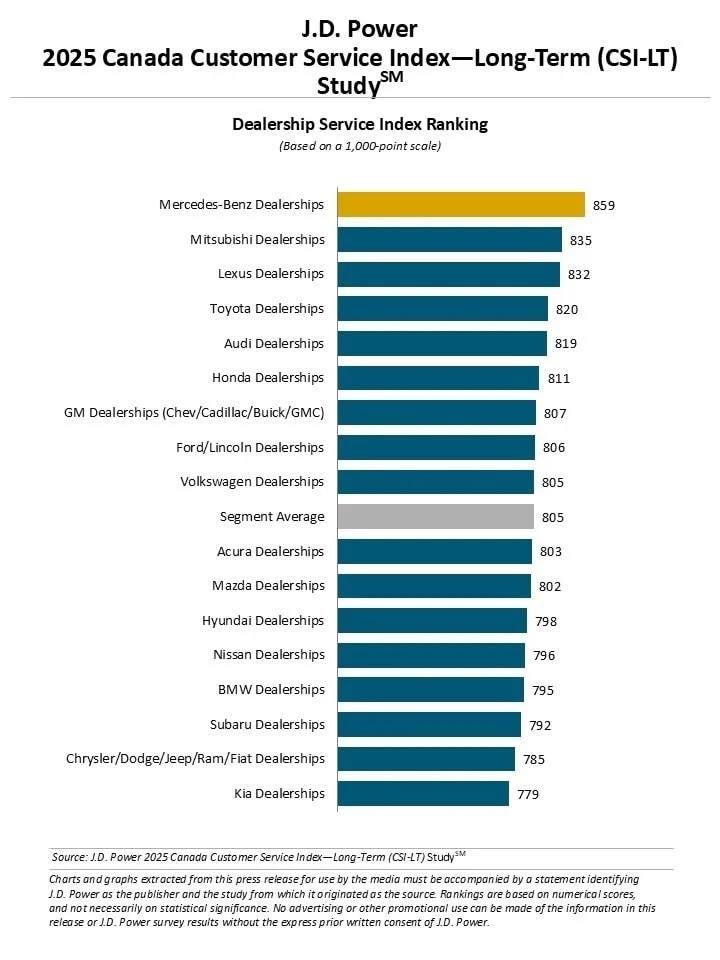

In this year’s J.D. Power CSI-LT Study, Ford dealers scored 806 out of 1,000 possible points, which places them just above the industry average of 805. It’s also good enough for eighth among all automotive brands, behind only Mercedes-Benz (859), Mitsubishi (835), Lexus (832), Toyota (820), Audi (819), Honda (811), and General Motors (807). Last year, Ford dealers ranked below the industry average with a score of 796, but their U.S. counterparts still fell below the mean in this year’s CSI study.

This year’s CSI-LT study is based on responses from 9,999 owners and is based on five factors – service quality; vehicle pick-up; service facility; service initiation; and service advisor. It found that overall, Canadian vehicle owners are holding on to their vehicles longer than ever, due to economic uncertainty fueled by trade tensions, inflationary pressure, and rising new-vehicle prices – meaning more frequent trips to the dealership for service as well.

“The auto service market in Canada is experiencing unprecedented growth, with revenue estimated at $18.8 billion, thanks to a combination of macroeconomic factors that are leading to stagnation in new light‑vehicle sales and driving up maintenance and repair costs,” says J.D. Ney, automotive practice lead at J.D. Power Canada. “This presents a unique opportunity for dealerships to offset softer new‑vehicle sales and for aftermarket facilities to capture a larger share of the revenue stream in a market where used‑vehicle owners are more price‑conscious.”

No Comments yet