Like much of the automotive industry, Ford inventory levels have been a bit all over the map in recent years, but have rebounded significantly since the ultra-low days of the pandemic and its resulting fallout. In fact, Ford inventory levels have risen so much that they've been among the highest in the industry on several occasions, hovering above the 100 days' supply mark during the course of more than one month. Things did improve earlier this year, but now, the Ford brand is experiencing another bit of a boom in terms of inventory.

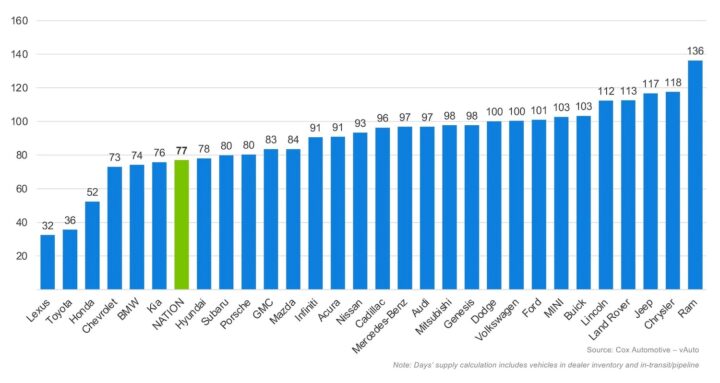

According to new data from Cox Automotive, Ford inventory levels closed out August at a 101 days’ supply, in fact, which is higher than July's 96 days, and it matches June's figure as well. Prior to that, Ford inventory levels stood at an 85 days’ supply in April and May. As for the overall industry, it averaged a 77 day's supply in August, with Ram leading the way at 136 days, followed by Chrysler (118 days), Jeep (117), Land Rover (113), Lincoln (112), Buick (103), and Mini (101) all ranking ahead of Ford or tying it.

These figures stand in stark contrast to certain other brands, which has been the case for some time now. Lexus (32 days' supply) and Toyota (36 days) continue to post the lowest inventory levels of any automotive brand in the U.S., in fact. Overall, days’ supply of new vehicle inventory was up 4.1 percent month-over-month but down 10 percent year-over-year. This indicates that even though inventory levels are increasing, vehicles are also turning on dealer lots quicker than a year ago, which reflects a more balanced market.

"Although inventory levels remain below last year’s benchmarks, the upward momentum in sales and pricing reveals a resilient and adaptive market," Cox Automotive noted. "The first half of 2025 saw significant inventory drawdowns as consumers rushed to purchase vehicles ahead of anticipated tariff-driven price hikes, while the latter half is beginning to show disciplined manufacturer replenishment strategies and selective focus on profitable, in-demand models."

"As we approach the final quarter of the year, attention will center on how automakers recalibrate production, respond to cost pressures, and leverage promotional activities, all while consumers weigh new incentives amid rising retail prices."

No Comments yet