Following years of record low levels of inventory, Ford has posted some of the highest inventory levels of any automotive brand for quite a few months now. That trend continued in March 2025, when Ford closed out the month at a 99 day’s supply of inventory, which was the ninth highest of any automotive brand and well above the overall average of 70 days. However, those same inventory levels are seemingly heading in the opposite direction now, which could have something to do with Ford's hyper-successful employee pricing for everyone inventive program that kicked off in early April.

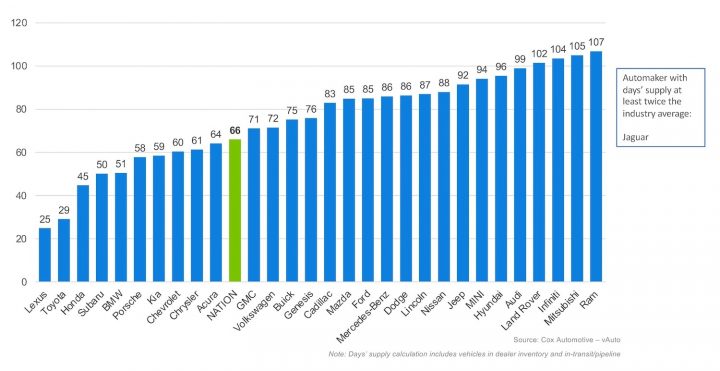

According to new data from Cox Automotive, Ford's days supply if inventory in April came in at 85, which is its lowest total in quite some time, as well as a big month-over-month drop. That also ranks the Ford brand behind Jaguar, Ram, Mitsubishi, Infiniti, Land Rover, Audi, Hyundai, Mini, Jeep, Nissan, Lincoln, Dodge, and Mercedes-Benz, albeit, also ahead of the likes of Lexus and Toyota - both of which posted a rather low days' supply total under 30 in April.

On the back of robust sales, overall unsold new vehicle inventory in the U.S. closed out April at 2.49 million units, which is 7.4 percent lower than 2.69 million units at the beginning of the month and down 10.5 percent from the same period one year ago. New-vehicle days' supply at the start of May was 66, down 16 days compared to last year and six days fewer than last month. According to Cox Automotive, it's likely that automakers are holding the proverbial line in terms of production and deliveries amid tariff uncertainties, but it still expects numbers to climb as 2026 model year vehicles arrive in showrooms, coupled with a potential rise in terms of pricing stemming from those same levies.

"Ford is among the few brands that have announced higher pricing for specific vehicles manufactured outside the United States, while other brands continue to develop their pricing strategies and promise to hold the line on current model-year products," the company said. "This period presents a challenge to market share, and despite the potential shift towards a seller’s market, thorough research by consumers can lead to unexpected purchasing decisions."

No Comments yet