Changan Ford – a 50:50 joint venture between FoMoCo and Changan Automobile in China – has historically performed well in various J.D. Power studies, including a third-place ranking in the 2024 China Vehicle Dependability Study (VDS). Now that the J.D. Power 2025 China Initial Quality Study (IQS) has been released, it reveals that Changan Ford once again managed to produce strong results in that particular area, too.

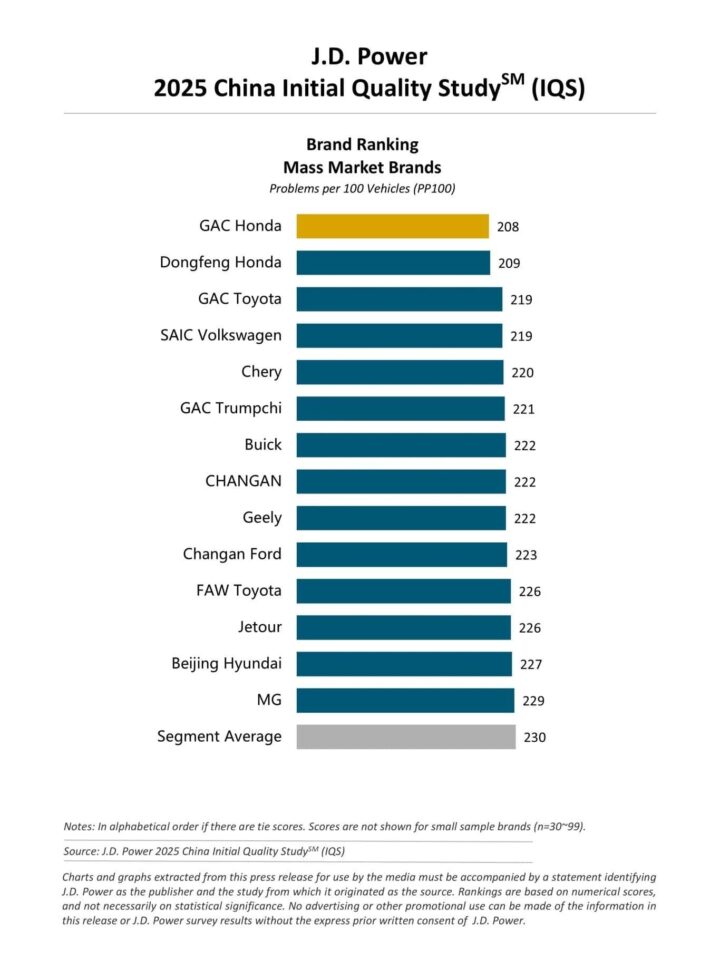

Among all mass market automotive brands in China, Changan Ford ranked tenth this time around with a score of 223 problems per 100 vehicles (PP100), coming in better than the segment average of 230 – performing better than Ford did in the U.S. version of the IQS, as a lower number reflects fewer problems and results in a better score. As for overall new vehicle quality in China, PP100 declined by 17 year-over-year to 229, with much of that coming from traditional internal combustion engine-powered vehicles.

The biggest issues this time around stemmed from design-related and manufacturer-related problems, as those grew by 9.0 and 8.8 PP100, respectively, compared to 2024. Additionally, infotainment (+5.2 PP100), seats (+3.3 PP100), and driver assistance (+1.8 PP100) all experienced more issues versus last year. Among the nine major problem categories in the China IQS, all increased in PP100 year-over-year except for powertrains, however.

“Against the backdrop of multiple competitive pressures in terms of industry technology, configurations and pricing, the IQS performance of traditional fuel-powered vehicles has sustained a pronounced year-over-year decline,” said Elvis Yang, general manager of auto product practice at J.D. Power China. “How to maintain market share and enhance perceived quality amid the new energy transformation is a key issue that ICE vehicle manufacturers must solve in the next few years.”

“At present, the top priority is to optimize the in-vehicle experience of technological configurations, focus on users’ high-frequency scenarios and make efforts to solve issues with strong user perception such as misidentification and slow response. Meanwhile, as the user structure and demand preferences of ICE vehicle owners change, automakers need to re-examine the user experience indicator system and quality risk control strategies and effectively put user-centric quality management at the forefront.”

No Comments yet